Building 24 Fourplexes In Utah — Our Experience - EP20

Jan 13, 2022A breakdown of the process we went through during a recent build-to-rent project in Payson, Utah. The development consisted of 24 new construction fourplexes in a stacked flat floor plan. This project had its ups and downs as we launched it in January 2020 before all the pandemic madness had begun.

So how did it go? Let's talk about it.

Subscribe to our show on YouTube: https://bit.ly/3K67LQe

Steve Olson: We are here after a long holiday, happy new year!

On this website, there are links to each of us so you can send us a message with thoughts and insults and suggestions or anything else that you might want to send.

What we want to talk about today is something that we hope that everybody will find useful.

We'd like to go through a recent build-to-rent deal that we did together. How it unfolded and what some of the challenges were and obstacles along the way.

If you like what we have to say and want to hear more about that kind of stuff, please leave some comments on the show.

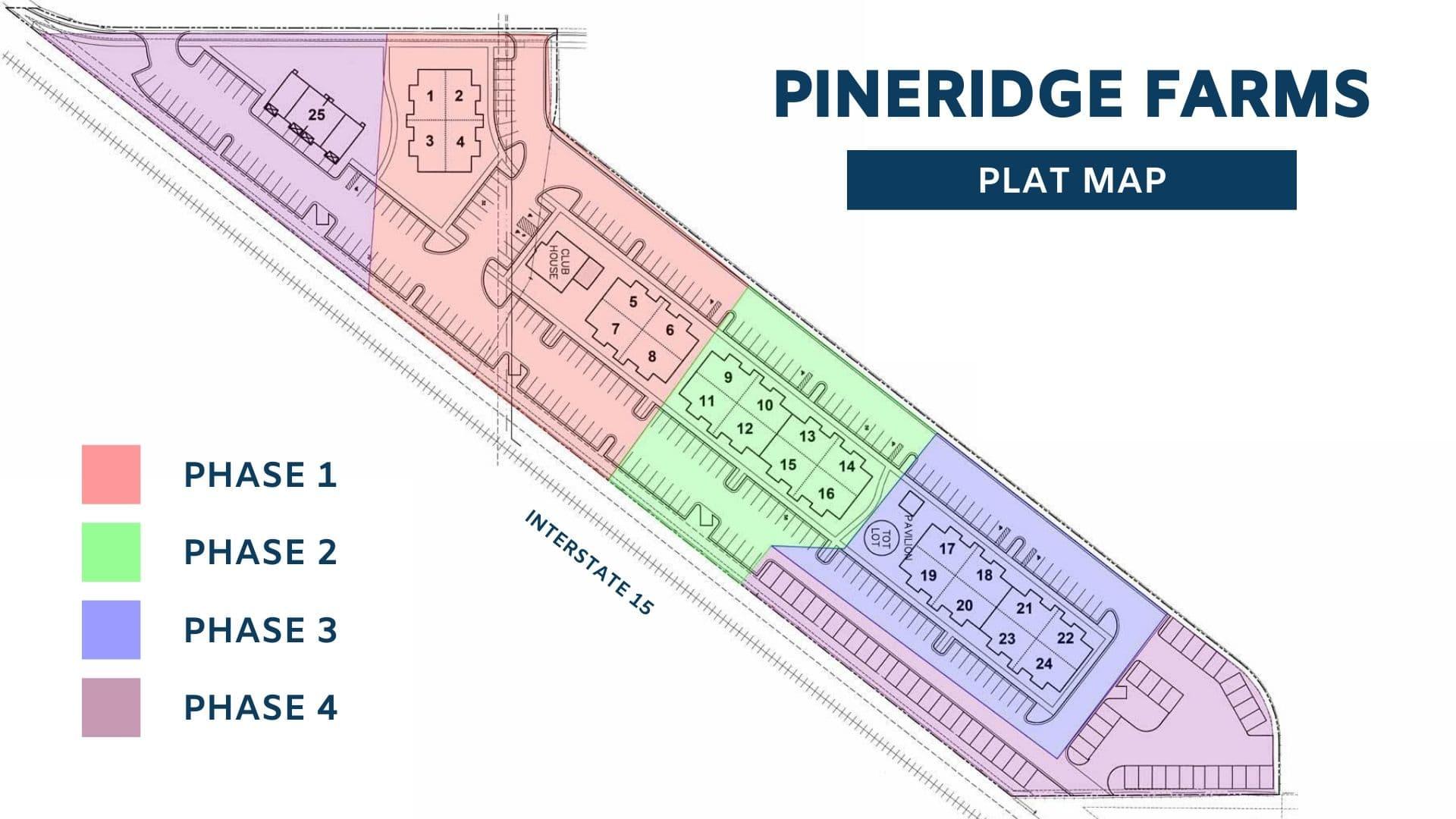

Recently we turned over the last unit in a project called Pineridge Farms, in Payson, Utah.

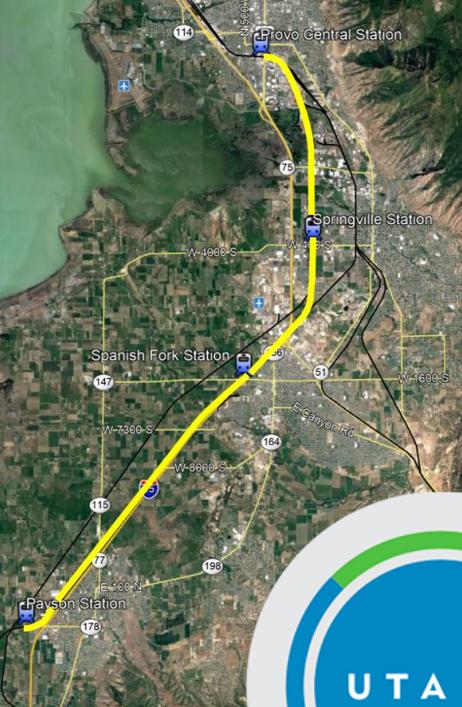

If you've ever driven on Interstate 15 in Utah, it's kind of the main freeway. It goes all the way from San Diego up to the Canadian border cuts right through the heart of the salt lake city Metro.

And this project is on the south side almost as far as you can get on the south side of the salt lake city, Metro, we started working on it in January of 2020, and we all know January 2020 things started to get a little bit crazy.

This was a fourplex deal. This is what we do together a lot of the time. It was fourplexes. This was brought to us by our land developer team.

But if you're looking at it from the outside, it's an apartment complex.

That's what it looks like to you. It was platted as fourplexes.

Each building was supposed to be a 16 unit building. Four-story building. And on each side is one unit.

So let's say you're in the Northeast corner of the building, your fourplex is the first, second, third, and fourth floor of that, of that building. And that's your fourplex so that we had an HOA that was responsible for the common area to the stairwell. Between the fourplexes. And then, of course, all the landscaping.

What did we have an amenities-wise plan on this project?

- Pool

- Tot lot

- Clubhouse

- Gym

The clubhouse has got to be, what 1800 square feet, 2000 square feet, maybe something like that. In there you've got leasing to slash HOA office, like a sitting area with a couch, kind of a gathering area, some lockers and bathrooms, and then a small gym area. Couple of treadmills and maybe some weights going in there. Not anything crazy. It was never intended to be anything crazy.

We got this project, let's kind of go through what happened since then. We got it on January 20 20, which one are you? Can you take me through kind of what happened over four months?

Chase Leavitt: We had it listed at $699,900. And like you said, it's a vertically stacked fourplex. You have a unit on each level, main level, second, third, and fourth. This was January 2020.

Launch the project. Things are actually going pretty good for the first couple of weeks. The first couple of. I think we probably had, at least did we get to half or a third?

Sherida Zenger: I'm sure. Close to probably half of it reserved because then people started going backward.

Chase Leavitt: Half reserved. It was March, middle, maybe first or middle of March, you know, COVID and 2020, we know what happened there. And I think that's where people started to get a little bit of hesitation. They started to pull back a little bit, very foreign. Didn't know what was going on. So we started to see a pullback in, we saw reservations starting to withdraw or cancel.

Steve Olson: So we had to get a whole list of people to reserve because they were going to get construction funds.

That's how we build this thing. Our developer team comes up with the money to buy the land, do all the civil work and get it ready, get it all the way to. Right. And then individual investors come in and close on construction loans. Our construction company builds the fourplexes. So you're saying people dropping like flies now, no longer a lot of investor interest.

Chase Leavitt: Maybe one, two, or three that stayed in there. We're still getting calls and people there wanting to talk about it, but the interactions, the reservations, and the interactions that we once had seem to dry up and get pretty cold, at least for one to two months.

Steve Olson: What were investors telling you when they call and said, "Hey, I'm out."

Sherida Zenger: I think they were just unsure. They, they didn't know, like, are you even going to be able to build this what's going on? See, I think there was so much uncertainty going on at the time that people were like, what's going to happen with construction loans. Shockingly though the construction lenders were still okay.

And still okay to land. There was never a pullback from them. I was really worried about that. Like none of them ever came to us and said, Hey, actually, we're going to have to put this project on hold. Right? Like this isn't something we're going to do. But I think it was just more the uncertainty. And I think a lot of people lost a lot of money in the stock market.

And so I think people were panicking saying, okay, where else, you know, how could I come up with funds? And this is just the unknown.

Steve Olson: Every other call I was getting was an investor. because you keep in mind, we had what, four other projects going in other areas at the time. And they were just dropping like crazy, you know, you've got a million dollars in your stock portfolio and I think it was what worth seven 50 over, over a couple of weeks.

Yeah, that was crazy. As you said, I was really worried about the construction lenders, turning tail and running. You're not wanting to loan construction and. We're uncharacteristically steadfast. They didn't even blink.

Sherida Zenger: It wasn't even a blip on their radar. They were like, okay, where's the next project let's get going.

I mean, I remember we were still closing some construction loans with other projects during that time. And we were all a little shocked. Like when are they going to pull the plug and say, we're not going to do anymore? I mean, think of Idaho, we were closing some of that Laguna and Entrata stuff at the same time.

Chase Leavitt: I want to say we're offering a six and a half cap. Isn't that where we were, or am I wrong there?

Sherida Zenger: It might've been a little higher than that.

Chase Leavitt: So maybe I think it was higher than seven, maybe seven, but it was a good cap rate. The numbers were good. So I feel like the investors weren't pulling out because of the numbers, they liked the investment and that's why they were calling us in the first place we're making reservations, but this, the uncertainty unknown is why they, they started to drop like flies.

Steve Olson: There was a big conversation that emerged at that time too. It still comes up occasionally everyone's talking about, I don't know if I can buy this, I don't know where cap rates are going to go up to right. In for the introductory listeners saying cap rates are going up. That's a fancy way of saying prices are going down.

Yeah. Right. And so they're all expecting, this, this mass eviction event that was, that was going to happen or. Even worse, landlords can't evict tenants yet they're not paying. So the rent rolls all tank and you're, you're full of a bunch of you. You have a bunch of units full of tenants that aren't paying rent, which is the worst kind of tenant to have.

And so now something that you would have sold for a 6% cap rate, you're going to have to sell for eight now to get somebody, to be willing, to take the risk and bring it on. So everybody was thinking if I were. The deals are going to get better.

Sherida Zenger: Did get a little bit better cause we had to go to the builder and it was this whole collective thing where, I mean, obviously, you know, we're real estate agents.

So we make money off of commissions. We had to take a little haircut in our commission. The builder took a haircut on his profit. You know the development team took a haircut on their end and we were able to kind of whittle that price down.

Steve Olson: The market wasn't behaving rationally.

Right. You, you couldn't have a real conversation there. There's just too much nonsense. And I think intuitively, everybody knew at some point it would calm down a little. Right. But I mean, you got to think this is March, April of 2020. This was when it was the. It at least here were, where we are in Utah and we owned the dirt.

Sherida Zenger: Like at that point, like we owned the, that we were in the deal, we couldn't back out. There was nothing else we could do. So then it became the point of how do we not lose more money, but still get some investors on board to fall through with this project.

Steve Olson: So that, it's a good point because the clock was ticking, you know, in this kind of business model, we use private care.

To buy the dirt to pay for all the civil work acquisition development money is what we call a and D money. And we owned it and the clock was taken on that interest and its expensive interest, by the way, this isn't like bank rates. You know, we're, we're talking in some cases, double-digit interest rates.

And so you've got millions of dollars tickets away at double-digit interest rates. We weren't really in a position where we could sit around and let the market figure itself. We didn't have that luxury because when it was going to do that was such an unknown. Yeah. So the question was, what price can an investor not ignore?

And this was the only time we've ever done this. And I hope it's the only time we ever. And I think we went from 6 99 down to what? 6 49. Yeah. I mean, you're so you're talking, these are 1050 square foot units. So you're, you're getting over 4,000 square feet of rentable space. And at that price, even in all the chaos and in the mayhem people start waking up, didn't they, I got their attention.

Got their attention. Not, not all the way. Cause what was funny would one of you take us through? Cause we went from no one will talk to them. Too. We lowered the price and some people started talking to us. I can still see the spreadsheet. We track everything on this spreadsheet. We bought each lot number with the investor's name next to it.

We always feel very, very good when we have at least 75% of that taken up with committed investors. So we went from like only a few hanging around to maybe what, 30-40%. And then all of a sudden people were mad that we didn't have anything left because a few things broke our direction.

Can one of you handle that?

Chase Leavitt: So I think we had a third when we dropped the prices or that just that first section of what eight. So the first two buildings were reserved. And so it was that the, I guess the other two-thirds. Took a little bit longer. And I think it was, I want to say it was the middle of May when things started to turn a little bit.

And I think there's still a lot of unknowns, but I feel like people just said, you know what, I'm still getting I need to invest my money, need to put it somewhere. And we started to get those calls again, all of a sudden, the second batch and then the third batch, and yeah, we're all, all reserved and filled up within probably about two to three months.

After that April period.

Steve Olson: Psychologically, yeah. I think the quote, unquote, lockdown, Utah, whatever that was that expired on May 1st? I remember. Cause I listed my personal residence for sale on May 1st and then it was so weird to see people just go, okay. It's okay now.

Sherida Zenger: It was like, okay, I'm going to turn it back on because I need to do something. I can't just keep sitting here. I think people were bored and thinking. There are still deals going on. I mean, everything didn't complete.

Steve Olson: I think his stock market had started to recover a little bit.

Yeah. Yeah. It was clear that it had bottomed out, but what else happened? So there were two other things that were announced that all of a sudden took us from being, Hey, this might be some kind of hillbilly project clear on the south side of the Metro that nobody wants to live at two, all of a sudden, definitely not that.

Sherida Zenger: Payson is about 12 minutes from Provo-- the main Provo exit. And, and they announced a track station. So our mass transit that takes you from w which will now be pacing clear up to like Ogden.

Steve Olson: I think it's going to even go further up to Brigham City at some point.

Sherida Zenger: So they announced that they're going to continue those tracks down further, which was huge for us. And then another school that is located in an ORM called Utah valley university UV. Announced that they're going to have a satellite location two blocks away. It's like off the exit to the right.

Like it was, it's just a couple of minutes away. And the track station is a couple of minutes away that gets right off that exit by that bowling alley.

Steve Olson: it's going to be five minutes. Not, not in a car. No. By walking on your feet.

Chase Leavitt: Yes. Yeah. So, yeah, Payson's kind of on the edge of Utah county right. South of salt lake county.

And so it's on the south end. And so when those two announcements came out, that I think that triggered some people where it's like, yeah, that's kind of where things are starting to head or trend. So it ended up being a huge home run.

Steve Olson: And the world's not ending. Then all of a sudden, didn't we Jack prices to 720k, something like that?

Sherida Zenger: That was Blackstone.

Steve Olson: There was another project that went ran sort of parallel to this, but I think we did go back up to 6 99 or so on the last bit of that we could check, but yeah, that, that thing evaporated, and then people that would not return your call in April were mad at you in May.

Why didn't you tell me? Well, I, we could look at my call history and I think I was a stalker. I called you so many times, right? Yeah. And so it can flip on a dime.

I think the moral of the story is here development and, and building a new product is a long, long runway and you have to be prepared for things.

And these are, these are clearly extreme examples that are going to have. During that are completely out of your control. And I think for every good one, there's a bad one and, and so on and so forth. But if you got in, right, you, they say you make your money when you buy. Right.

Well, this one was an interesting one because we were dealing with the unknown of the pandemic.

Yeah. And then on the flip side of it, these are completed and we're getting a little more in rent than we thought, but then we've had two of them resell already at kind of the top of the market. So it's kind of this weird thing. And so when people are like, oh, what was the equity spread there? It's an astronomical number.

And so I have to tell people, but that's not typically what we see at our event. Our investors used to see a 100-150k in equity, upon completion. Now they were seeing insane amounts.

Chase Leavitt: We were projecting when we started the $699,900, and then we had the market value of 850k.

So that was a pretty dang good spread. And then like you're talking about, we just, we just resold. Couple months ago for 1,000,050. Yeah.

Steve Olson: Well, because clients come in, you know, they, they got a construction loan two years ago or whatever. They waited for all the development in the building to happen and the lease-up and they sat there for a while and they said, I wonder what it looked like if I sold.

It's just a small version of a value add is really what it is, but it's crazy, you know, the fourplexes sell for more, I think, per door, because somebody can use that conventional Fannie Mae money to buy them. So at least up fourplexes is viewed as a very secure source of income. The construction on that, I think for the most part went smoothly except for our pool.

Does anyone want to take the pool?

Chase Leavitt: Well, it just ended up being quite a bit smaller than what we're anticipating or expecting overall. When I look at the videos or go over there, it's a great, great project colors look great. It looks clean. It does little, a nice little clubhouse. Yeah, grass areas, landscaping looks good and it's even pretty close to the I-15 freeway.

And so when it came to lease-up, that didn't matter.

Steve Olson: Filled up fast with a sign out there and a hundred thousand cars a day. Well, probably way more than that down there. Yeah. Go past it. But you know, you ask yourself like, how does your pool end up way smaller than you expected? We don't have a great answer for you on that, but it can happen.

You can get miscommunications between your, your, your builder, your civil guys, and, and you gotta just kind of muscle through it and work it out. It hasn't turned out to be a problem at all on the lease-up, but it's going to be a. Small pool that we just have to deal with a glorified, hot tub.

Sherida Zenger: Hey, there are some amenities there are other units down in that area that doesn't have an amenity like that. Even look at our Provo project. We don't have a menu. There's not a clubhouse or anything. So I think, you know, 10-12 minute difference in drive time for a location. We have great amenities there.

Yeah. I think that's, what's going to draw and continue to draw a tenant to that.

Steve Olson: Remember analyzing it too. Cause we were comparing it to some other locations in south Provo and looking at a map or taking a client there. It looked like it was just so far away. But the funny thing about it is it takes you a grand total of like two minutes to be on the freeway from this project.

And then you're like seven to 10. To get off and get it to all the major retail by Utah valley university and pro and everything. And so some of this other inventory that we were worried about is competition in south Provo actually takes longer to get to the major retail because it's located so deep within the city.

You've only got surface streets, whereas this one bam freeway, and you're there. So these are all intangible things I think about. So here we are. The con all the units are occupied, I believe. Yep. Construction on the units themselves as done the covered parking is getting installed on the front rows.

We're putting in covered parking there. And I think they've they're mopping up a few details on some of that. We did some for rent, garages, detached garages of that tens can rent from the HOA. I think it's been one of the more successful projects we've had. We know this, when we hear from investors, right.

If they're having a hard time, we're going to hear about it and we help them with it. I don't think I've had a peep other than, Hey, when are you doing this again?

Sherida Zenger: I haven't had anyone reach out saying, Hey, I'm having problems with this or with that. And that's how we like it.

Chase Leavitt: I can go back just a little bit and speak from a personal investor standpoint at, at the $699,900, when we first started selling that, I liked it and that's why I was selling it.

I didn't jump in at that time and then COVID hit pandemic and then it dropped the price. I saw the cap rate and cash flow even get a little bit better. And then that's when at that time I was doing some other investing through the Fourplex Investment Group, had a couple of units reserved in Provo and so I was just spread out and didn't have a ton of capital and I said, Hey, pops, dad, you know, you want to, you want to jump in on this?

And so we went 50 50 on a, on a fourplex there and it ended up being a home run. So just from a personal investor standpoint, it was, it was definitely a good one. Very happy about it.

Sherida Zenger: I mean, that shows that we like our inventory and our product because all three of us invest in our own projects, which I think speaks volumes.

Steve Olson: Yeah, for sure. And by the way, this was a good one. We have some projects that have been stinkers. And so what we'll definitely talk about some of those on a future episode, what we did wrong. We've since learned from that and how we're adjusting and so on.

Thank you for listening to the Build-to-Rent show. Remember to subscribe on Spotify, iTunes, or wherever you get your podcasts and check us out at www.b2rshow.com.

Submit A Question To Be Covered On The Show!

Let us know what topic(s) you want covered in a future episode.

*Submitting this form opts you in to receive news and updates from our team.